The accuracy and efficiency of AI stocks and trading platforms is crucial to ensure you're relying on the right tool to provide solid insights and accurate predictions. These are the top 10 ways to evaluate these platforms effectively:

1. Backtesting Results

What to look for: Make sure the platform you choose to use allows you to conduct back-testing to test the accuracy of its predictions based on historical data.

Why it matters: Backtesting helps to validate the AI models accuracy by comparing their predictions against actual historical results.

Look for platforms with customizable backtesting parameters.

2. Real-time Performance Monitoring

What to Watch Out For What happens to the platform during real-time conditions.

Why it's Important: Real-time performances are a better indication of the effectiveness of a system than the backtesting of the past.

Tip: Monitor live forecasts in real time and compare them to market developments by using a demo or a trial for free.

3. Prediction Error Metrics

What to Look For Measurements such as Mean Absolute Error and Root Mean Squared Error or R-squared to gauge the accuracy of predictions.

What is the significance of these metrics provide a quantifiable way to gauge how closely predictions are to actual results.

Tip : Platforms with openly shared metrics are generally more transparent.

4. Winning Rate and Ratio of Success

What to Look For Look for the platform's win rate (percentage of accurate predictions) and the success ratio (profitability of trades that are based on forecasts).

What is important Why it matters: A high winning rate and success ratio indicate better predictability and profitability.

Tips: Be wary of websites that boast untrue winning rates (e.g., 90 %+), as there is no perfect system.

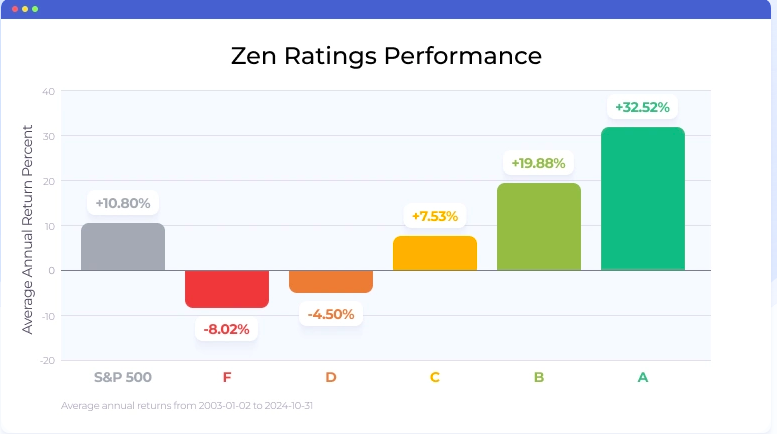

5. Benchmarking Against Market Indices

What to look out for: Examine the predictions and performance of the platform against major market indices.

Why it is Important This will help determine whether the platform outperforms or underperforms the broader market.

TIP: Look for consistent outperformance over multiple intervals, not only quick-term gains.

6. Congruity of Market Conditions

What to watch out for: How the platform performs when there are different market conditions.

The reason it's important A solid platform can perform well in all markets, not just those with favorable conditions.

Tip: Test the platform's predictions during volatile market conditions or when there is a period of low volatility.

7. Transparency in Methodology

What to look out for: Understand AI algorithms and models (e.g. reinforcement learning and neural networks, reinforcement learning, etc.).

What is important Transparency in methodology lets you assess the reliability and scientific rigor of the system.

Beware of platforms that make use of models that are "black boxes" without describing the process by which predictions are made.

8. User Reviews and Independent Testing

What to Look For: Read user reviews and look for independent testing or third-party evaluations of the platform.

Why it matters: Independent test results and reviews provide objective insight into the accuracy of the platform and performance.

Look through forums like Reddit or copyright to see what others have to say about their experiences.

9. Risk-Adjusted Returns

What to look for: Use risk-adjusted metrics, such as the Sharpe Ratio (or Sortino Ratio), to assess the platform's performance.

What's important The metrics are a reflection of the amount of risk taken to earn results. They offer a more accurate view of overall performance.

Sharpe Ratio: If it's extremely high (e.g. greater than 1) This indicates higher returns when risk is taken into account.

10. Long-Term Track Record

What to look for: Find out the overall performance of the platform over time (e.g. 3 to 5 years).

What's the point. Long-term performance can be an excellent indicator of reliability than results from short-term.

Beware of platforms that promise only a short-term gain or cherry picked results.

Bonus Tip Test using Demo Account

Check out the platform's real-time prediction with a trial or demo account, without risking any money. This allows you to assess accuracy and performance in real-time.

If you follow these guidelines, you can test the accuracy as well as performance of AI platforms for stock analysis and forecasting. Pick one that is in line with your needs for trading and the risk you are willing to take. It is essential to understand that there isn't a perfect platform. The best strategy is to mix AI insight and your own analysis. Check out the top rated ai for stock trading for site recommendations including ai chart analysis, ai stock picker, stock ai, best ai stock trading bot free, ai trade, best ai for trading, best ai stock trading bot free, chart ai trading assistant, ai investing, using ai to trade stocks and more.

Top 10 Tips To Evaluate The Updates And Maintenance Of Ai Stock Predicting/Analyzing Platforms

To ensure that AI-driven platform for stock trading and prediction remain safe and efficient, they must be regularly updated and maintained. These are the top 10 suggestions to evaluate their update and maintenance practices:

1. Updates occur frequently

Tips: Make sure you know how frequently the platform updates (e.g. weekly or monthly, or quarterly).

Why? Regular updates demonstrate the active development of the company and its ability to react to market changes.

2. Transparency in Release Notes

Check out the notes included in the platform's Release Notes to learn about the improvements and modifications have been made.

The transparent release notes demonstrate that the platform is dedicated to continuous improvements.

3. AI Model Retraining Schedule

Tip - Ask how often AI models are trained on new data.

Why? Markets change and models have to be re-evaluated to maintain the accuracy.

4. Bug fixes, Issue resolution

Tip: Determine how quickly the platform reacts to issues or bugs that users report.

Reason: Rapid bug fixes help ensure the system's stability and function.

5. Updates on Security

Tip: Check if the platform updates its security protocols frequently to ensure the security of data of users and trading activities.

Why? Cybersecurity is important in financial platforms, to prevent fraud.

6. New Features Integration

Tip: See if there are any new features that are being introduced by the platform (e.g. advanced analytics or data sources, etc.) in response to user feedback or market trends.

What's the reason? New features demonstrate flexibility and responsiveness to the needs of users.

7. Backward Compatibility

TIP: Make sure that the upgrade doesn't cause major disruption to existing functionality or require significant reconfiguration.

Why: Backward compatibility ensures an enjoyable user experience during transitions.

8. Communication between Maintenance and the User Personnel

TIP: Assess the way in which your platform announces scheduled maintenance or downtimes to users.

Why is that clear communication builds trust and minimizes disruptions.

9. Performance Monitoring, Optimization and Analysis

TIP: Ensure that the platform continuously monitors the performance metrics like accuracy or latency, and also optimizes their platforms.

The reason is that ongoing improvement can make sure that the platform is efficient.

10. Compliance with regulatory changes

Tips: Check if the platform is updating its policies and features to comply with new laws on data privacy or financial regulations. laws.

Why: To avoid legal liability and to maintain user confidence, compliance with the regulatory framework is essential.

Bonus Tip! User Feedback is incorporated into the program.

Find out if the platform incorporates user feedback into its updates and maintenance procedures. This shows that the platform is focusing on customer feedback to improving.

It is possible to evaluate these factors to make sure you are selecting a system for AI stock predictions and trading which is up-to current, well-maintained, and able to adapt to the changing dynamics of the market. Follow the top rated his comment is here about how to use ai for stock trading for website advice including ai options, ai stock investing, best ai trading platform, ai stock investing, ai stock price prediction, ai stock trader, ai stock prediction, best ai trading platform, ai stock prediction, best stock prediction website and more.